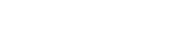

Cheongung-II with 95% Localization Rate: Breaking into the Middle East, Advancing into Europe

페이지 정보

본문

K-Supply Chain Report

Part 2·(3) K-Defense Leading the Middle East Boom

No issues with Cheongung-II supply chain stabilization.

Leverages strengths in delivery time, price, and quality competitiveness.

₩12 trillion export to UAE, Saudi Arabia, Iraq.

RFHIC’s revenue increased 20%.

Expectations for MRO orders from Eastern Europe.

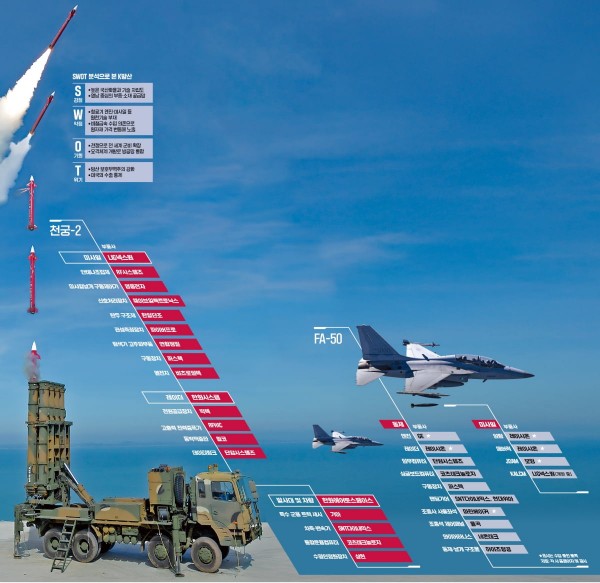

FA-50 light combat aircraft: 60% localization rate.

Mass production successful, but core technologies still lacking.

Need to reduce reliance on Chinese raw materials.

A joint project by Hankyung and the Korea Institute for Industrial Economics & Trade.

South Korea’s defense exports are becoming more diversified. The focus is shifting from Army-centered ground weapons to high-value Navy and Air Force systems. Bestsellers now include not only the K-9 self-propelled howitzer and the K-2 tank, but also the Cheongung-II interceptor missile and the FA-50 fighter jet. Thanks to high localization rates, the trickle-down effect to domestic partners is significant, but the heavy dependence on Chinese raw materials remains an issue.

◇ Cheongung-II technologies applicable to other industries

Since mass production began in 2018, Cheongung-II has reached a localization rate of 95% in just seven years, establishing itself as a flagship product of the K-defense industry alongside the K-9. Amid growing tensions in the Middle East, export contracts totaling more than ₩12 trillion have been signed with the UAE, Saudi Arabia, and Iraq.

RFHIC, which produces power amplifiers for Cheongung-II radar, reported ₩31.9 billion in Q1 sales, up more than 20% year-over-year. Operating profit increased from ₩1.5 billion to ₩3.7 billion. KOTZ Technologies, which supplies the integrated operation computer, achieved ₩13.6 billion in Q1 sales, a 50% increase from ₩9.1 billion a year earlier. Operating profit rose from ₩1.1 billion to ₩1.9 billion. Locadi, a multifunction radar (MFR) parts supplier, posted ₩24.7 billion in sales last year, a 53% increase over the previous year.

Jang Woo-hyuk, head of the Defense Industry Strategy Team at the Defense Technology Promotion Research Institute, said, “Localizing components improves the performance of domestic companies and reduces costs by replacing expensive imported parts. It also frees us from export controls imposed by component-producing countries and enables continued logistics support for consumables.”

Cheongung-II component suppliers are also recognized for having technologies applicable in other fields. RFHIC’s gallium nitride (GaN) wafer manufacturing technology is critical for both defense and power semiconductors. FiberPro’s integrated navigation system is used not only in guided weapons but also in drones, tanks, and self-propelled howitzers.

Following success in the Middle East, additional orders from Europe are expected. With a supply chain centered in Changwon, South Gyeongsang Province, the system is well-positioned to expand into maintenance, repair, and overhaul (MRO) services. An official from LIG Nex1 said, “Eastern European countries still using Russian air defense systems are increasingly demanding replacements. Given the interceptor missile system's need for regular maintenance, demand for MRO services is likely to grow.”

◇ FA-50: Core technology still lacking

FA-50 component suppliers located near Korea Aerospace Industries (KAI) in Sacheon, South Gyeongsang Province, are also seeing strong growth. Danam Systems, which produces the mission computer that controls the FA-50’s avionics, posted ₩73.8 billion in sales last year, nearly 30% growth. Operating profit surged from ₩1.3 billion to ₩3.6 billion. PIRSTech, which supplies the missile actuator, saw Q1 sales jump to ₩53.6 billion, a nearly 50% increase year-over-year. SolDefense, which supplies computer control boards, increased its sales from ₩47.7 billion to ₩57.9 billion, up 21%.

While FA-50 component companies receive high marks for production capability, they fall short in core technologies. A report published this January by the Korea Institute for Industrial Economics & Trade and the Korea Defense Industry Association showed FA-50’s intellectual property score was only 2.4 out of 5. The airframe received a perfect score (100 out of 100) based on U.S. benchmarks, but avionics and armaments scored only 85 and 75, respectively.

Its relatively low localization rate of around 60% is also a weakness. Because production volumes for each component are small, it is difficult to justify the large investments needed to develop proprietary technologies. A KAI official said, “When you produce parts in batches of just 100 to match the number of aircraft, it’s hard to make a profit. Every part, from bolts and nuts to bearings, must be individually certified, which significantly increases maintenance costs.”

Not only the FA-50, but also Cheongung-II remains heavily dependent on Chinese raw materials. Neodymium, used in permanent magnets for guided weapons and missiles, is almost entirely sourced from China. Gallium, essential for the power amplifiers used in radar systems, is also effectively monopolized by China.